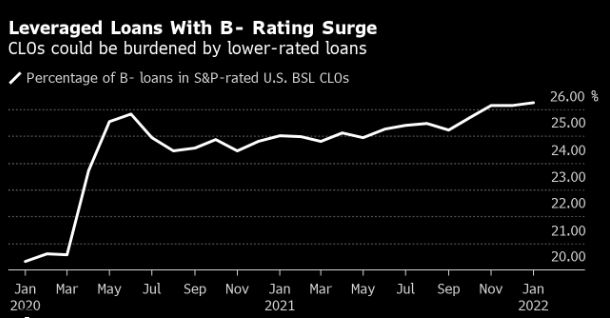

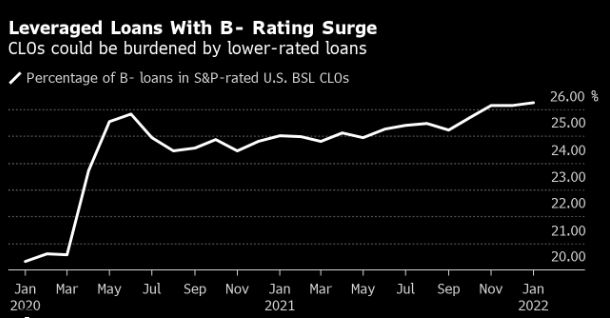

U.S. Leveraged Finance and CLO Weekly (U.S HY Default Rates Rose with Higher Interest Rates

Kampanya severler için hazırlanan Bettilt seçenekleri cazip hale geliyor.

Gerçek zamanlı sonuç güncellemeleriyle Bettilt fark yaratıyor.

Yeni kullanıcı kayıtlarında ekstra ödüller veren deneme bonusu veren bahis siteleri dikkat çekiyor.

Bahis sektöründe teknolojiyi etkin kullanan Bettilt casino, yapay zeka destekli sistemleriyle adil ve güvenli bir oyun ortamı sağlar.

Yeni özellikleriyle https://clearview-realty.com/ dikkat çeken, kullanıcıların heyecanını artırıyor.

Canlı oyun sağlayıcıları, masa başına ortalama 150 MB veri aktarımı yapmaktadır; bu, yüksek hız bahsegel kimin gerektirir ve düşük gecikmeli bağlantılar kullanır.